Sustainability/ESG reporting involves publicly disclosing an organisation’s ESG goals, performance, risks, opportunities and impacts. Sustainability reporting provides stakeholders with a comprehensive summary of an organisation’s sustainability efforts and commitments.

Air pollution emissions are considered an important material topic for many organisations, such as the construction and transportation sector. The Air Pollution Footprint Partnership tool is designed to provide the results you need to feed into your sustainability/ESG reporting and improve your overall ESG rating and stakeholder and investor confidence. The tool allows you to establish a baseline and from that, you can begin to plan for how you can reduce your emissions. A key part of ESG/sustainability reporting is showcasing transparency in relation to your organisation’s environmental impact and our tool allows you to lay the foundations for air pollution emissions reporting.

Frameworks and Standards Used for Reporting

Common standards such as GRI (Global Reporting Initiative), IFRS-SASB (International Financial Reporting Standards)-(Sustainability Accounting Standards Board) and TCFD (Task Force on Climate-related Financial Disclosure) offer guidance for structuring the reporting of air pollutant emissions and its impact for an organisation.

IFRS - SASB

IFRS SASB Standards enable organisations to provide industry-based disclosures about sustainability-related risks and opportunities that are financially material and could be expected to affect the entity’s cash flows, access to finance or cost of capital over the short, medium or long term. SASB Standards identify the sustainability-related issues most relevant to investor decision-making in 77 industries. Three out of the eleven overarching industry standards require reporting on air quality/emissions.

Click here to find which SASB standards could apply to your industry.

GRI

GRI is an independent organisation that helps organisations take responsibility for their impacts, by providing a common language to publicly disclose and communicate these impacts to their stakeholders.

Click here to find out more about how to use the GRI standards and click here to find out more about how to use the GRI 305 Emissions 2016 standard to prepare your organisation’s air quality impacts in accordance with the GRI standards.

TCFD

TCFD reporting is a framework for disclosing the material financial impacts of climate change on an organisation. IFRS S2 requirements align with the four core TCFD recommendations and its eleven recommended disclosures. Climate-related issues such as air quality can have a direct or indirect impact on how an organisation can operate.

Click here to find out more about TCFD reporting.

Recent Legislation

CFD

The UK Governments CFD (Government’s Climate-related Financial Disclosure) regulations requires public disclosure on climate change related risks and opportunities such as air quality. It requires disclosure against how climate change is addressed in corporate governance; the impacts on strategy; how climate related risks and opportunities are managed; and the performance measures and targets applied in managing these issues.

CSRD

The CSRD (Corporate Sustainability Reporting Directive) is recent legislation that legally obligates many companies to report on their sustainability matters in the near future by the European Commission.

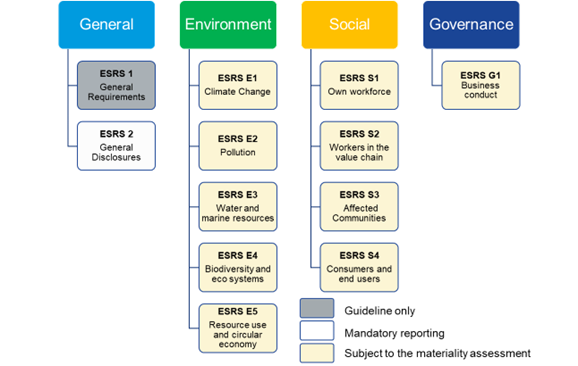

Affected companies will be required to report in alignment with the ESRS (European Sustainability Reporting Standards), which are legally binding within the CSRD. The ESRS was established by EFRAG (European Financial reporting Advisory Group) to standardise the way companies across the EU report on sustainability.

The Air Pollution Footprint Partnership tool is designed to provide the results you need to feed into your sustainability reporting and help you to meet such standards.

With the introduction of the CSRD, sustainability reporting in line with the ESRS is no longer optional for companies operating in the EU. Successful implementation of the ESRS ensures compliance with the CSRD. CSRD will apply to all:

- Companies listed on regulated markets in the EU (apart from listed micro-enterprises), and large companies. The CSRD classifies a large company as one that meets two out of three of the following criteria:

- more than 250 employees

- a turnover of over €40 million and over

- €20m total assets

- Listed SMEs, although there will be a transitional period when SMEs can opt out until 2028.

- Non-EU companies with a net turnover of €150 million in the EU, and with at least one subsidiary or branch in the union.

There are 12 ESRS, covering a range of Environmental Social Governance (ESG) issues. ESRS E1: Climate Change addresses several greenhouse gases connected to air pollution and ESRS E2: Pollution requires organisations to provide information on its pollution of air (indoor and outdoor).

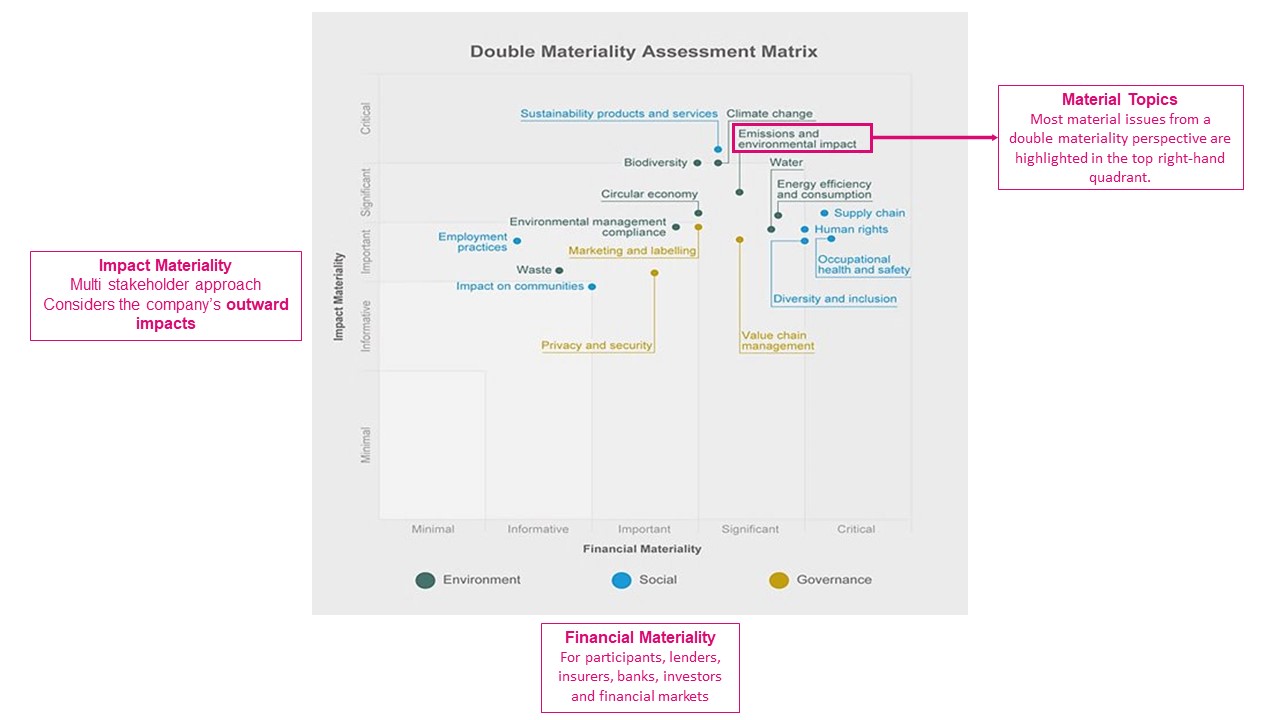

Organisations in scope of the CSRD will need to first assess which topics to report on using the double materiality concept, which requires information that is material from either a financial perspective or an impact perspective.

The figure below details an example of a double materiality matrix where air emissions (Emissions and environmental impact) are considered a material topic to the example organisation from an impact and financial perspective. The impact perspective refers to the organisation’s impact on the air quality in a particular location. The financial perspective refers to how the air quality in particular locations can impact the organisation’s business operations. Click here to find out more about the double materiality process.